All Categories

Featured

Table of Contents

Various policies have different optimum degrees for the quantity you can invest, up to 100%., is included to the money worth of the plan if the indexed account reveals gains (usually determined over a month).

This suggests $200 is included in the cash value (4% 50% $10,000 = $200). If the index drops in worth or remains steady, the account internet little or nothing. But there's one advantage: the insurance policy holder is secured from incurring losses. They perform like securities, IULs are not considered financial investment safeties.

Having this implies the existing cash worth is shielded from losses in a poorly performing market. "If the index produces a adverse return, the customer does not get involved in an unfavorable crediting price," Niefeld claimed. Simply put, the account will not lose its original cash money worth. The cash money worth builds up tax deferred, and the survivor benefit is tax-free for recipients.

Insurance Index

For example, a person who develops the policy over a time when the market is choking up might wind up with high premium settlements that do not add at all to the cash value. The policy can after that possibly lapse if the premium repayments aren't made on time later in life, which can negate the point of life insurance altogether.

Boosts in the cash value are limited by the insurance provider. Insurer typically establish optimal participation rates of much less than 100%. On top of that, returns on equity (ROE) indexes are usually covered at specific amounts during good years. These limitations can restrict the real rate of return that's attributed towards your account annually, no matter exactly how well the policy's hidden index performs.

The insurance company makes money by maintaining a portion of the gains, including anything over the cap.

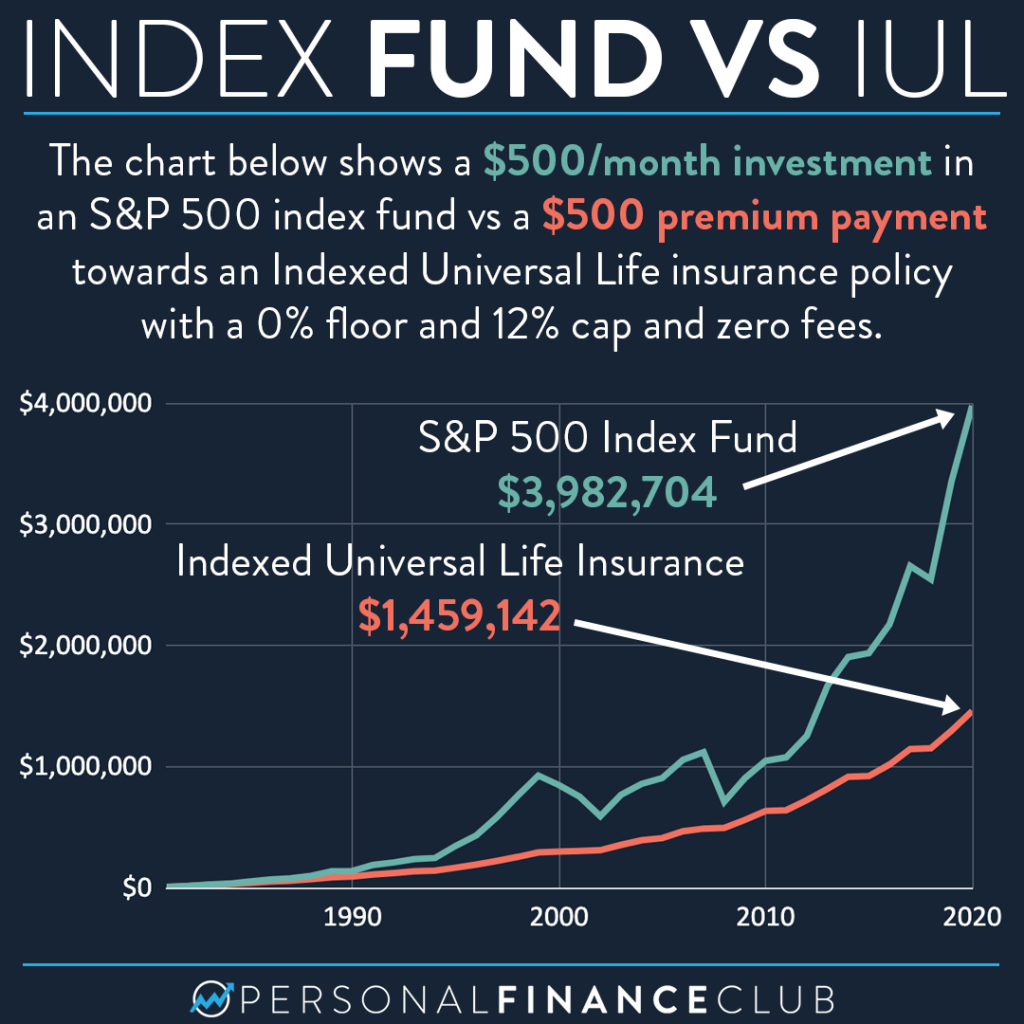

The possibility for a better rate of return is one advantage to IUL insurance policy policies compared to various other life insurance plans. However, bigger returns are not assured. Returns can in reality be reduced than returns on various other items, depending on how the marketplace carries out. Insurance policy holders have to approve that danger for possibly greater returns.

In the event of policy termination, gains come to be taxable as earnings. Charges are typically front-loaded and developed right into intricate attributing rate computations, which might perplex some investors.

Terminating or surrendering a policy can lead to more expenses. Pros Offer higher returns than various other life insurance coverage plans Enables tax-free resources gains IUL does not lower Social Safety and security advantages Plans can be developed around your threat appetite Disadvantages Returns capped at a particular level No guaranteed returns IUL may have greater charges than other plans Unlike other kinds of life insurance coverage, the worth of an IUL insurance coverage plan is linked to an index tied to the stock market.

How Much Does Universal Life Insurance Cost

There are lots of other sorts of life insurance policy plans, discussed below. Term life insurance policy uses a set benefit if the insurance policy holder passes away within a set amount of time, typically 10 to three decades. This is one of one of the most affordable sorts of life insurance policy, as well as the simplest, though there's no cash value accumulation.

The plan gains worth according to a repaired timetable, and there are fewer costs than an IUL insurance coverage policy. Variable life insurance comes with even more versatility than IUL insurance, suggesting that it is additionally more complex.

Bear in mind, this kind of insurance policy stays undamaged throughout your whole life simply like various other permanent life insurance policy plans.

What Is Guaranteed Universal Life

Bear in mind, however, that if there's anything you're not sure of or you're on the fence regarding getting any kind of kind of insurance policy, make sure to seek advice from a specialist. By doing this you'll understand if it's affordable and whether it matches your financial strategy. The price of an indexed universal life policy depends on several elements.

However, you will lose the survivor benefit named in the policy. Indexed global life insurance and 401(k) prepares all have their very own advantages. A 401(k) has even more financial investment options to select from and may come with a company suit. On the other hand, an IUL includes a survivor benefit and an extra money worth that the insurance holder can obtain versus.

Indexed universal life insurance policy can help you meet your family's needs for monetary defense while additionally building cash money value. Nevertheless, these policies can be extra intricate compared to various other kinds of life insurance coverage, and they aren't necessarily best for each capitalist. Talking with an experienced life insurance agent or broker can assist you choose if indexed universal life insurance policy is a great suitable for you.

Regardless of just how well you intend for the future, there are events in life, both anticipated and unforeseen, that can impact the monetary health of you and your loved ones. That's a reason for life insurance. Fatality benefit is usually income-tax-free to recipients. The fatality advantage that's normally income-tax-free to your recipients can aid guarantee your family will be able to maintain their criterion of living, assist them keep their home, or supplement lost income.

Points like prospective tax obligation increases, inflation, monetary emergencies, and preparing for events like university, retirement, or perhaps wedding celebrations. Some kinds of life insurance can assist with these and various other concerns also, such as indexed global life insurance coverage, or merely IUL. With IUL, your plan can be a funds, due to the fact that it has the potential to develop worth over time.

You can select to obtain indexed rate of interest. An index might influence your passion credited, you can not spend or directly take part in an index. Below, your plan tracks, yet is not in fact purchased, an outside market index like the S&P 500 Index. This hypothetical example is offered illustrative functions just.

Index Life Insurance Companies

Charges and costs may minimize policy worths. This interest is secured. So if the marketplace drops, you won't shed any rate of interest because of the decline. You can also choose to obtain fixed interest, one set foreseeable rate of interest price month after month, no issue the market. Since no solitary allocation will be most reliable in all market environments, your financial specialist can aid you identify which mix might fit your financial goals.

That leaves more in your policy to possibly maintain expanding over time. Down the road, you can access any readily available money value via plan car loans or withdrawals.

Talk with your financial specialist about how an indexed universal life insurance policy plan might be part of your total financial technique. This web content is for general educational functions only. It is not intended to give fiduciary, tax, or legal guidance and can not be made use of to stay clear of tax obligation fines; neither is it meant to market, promote, or advise any tax plan or plan.

Iul Life Insurance Companies

In case of a gap, impressive policy financings over of unrecovered cost basis will go through average income tax. If a plan is a customized endowment agreement (MEC), plan loans and withdrawals will be taxable as average earnings to the extent there are earnings in the policy.

Some indexes have numerous variations that can weight parts or may track the impact of rewards differently. An index may influence your interest attributed, you can not acquire, straight participate in or obtain dividend repayments from any of them via the plan Although an outside market index may impact your interest credited, your policy does not straight participate in any supply or equity or bond investments.

This content does not apply in the state of New York. Guarantees are backed by the monetary strength and claims-paying ability of Allianz Life Insurance Policy Company of North America. Products are provided by Allianz Life Insurance Business of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Universal Life Insurance Rate

The info and descriptions had below are not intended to be total descriptions of all terms, conditions and exclusions appropriate to the products and services. The specific insurance protection under any nation Investors insurance item undergoes the terms, problems and exclusions in the actual policies as provided. Products and services explained in this web site vary from state to state and not all items, coverages or services are offered in all states.

Your present web browser could restrict that experience. You may be utilizing an old internet browser that's unsupported, or setups within your web browser that are not compatible with our site.

Cost Of Insurance Universal Life

Currently using an upgraded browser and still having trouble? Please give us a call at for more aid. Your present browser: Finding ...

Table of Contents

Latest Posts

Self Banking Whole Life Insurance

Life Rich Banking

Infinite Banking Definition

More

Latest Posts

Self Banking Whole Life Insurance

Life Rich Banking

Infinite Banking Definition